By Sara Woggerman, Owner & President – ARM Compliance Business Solutions

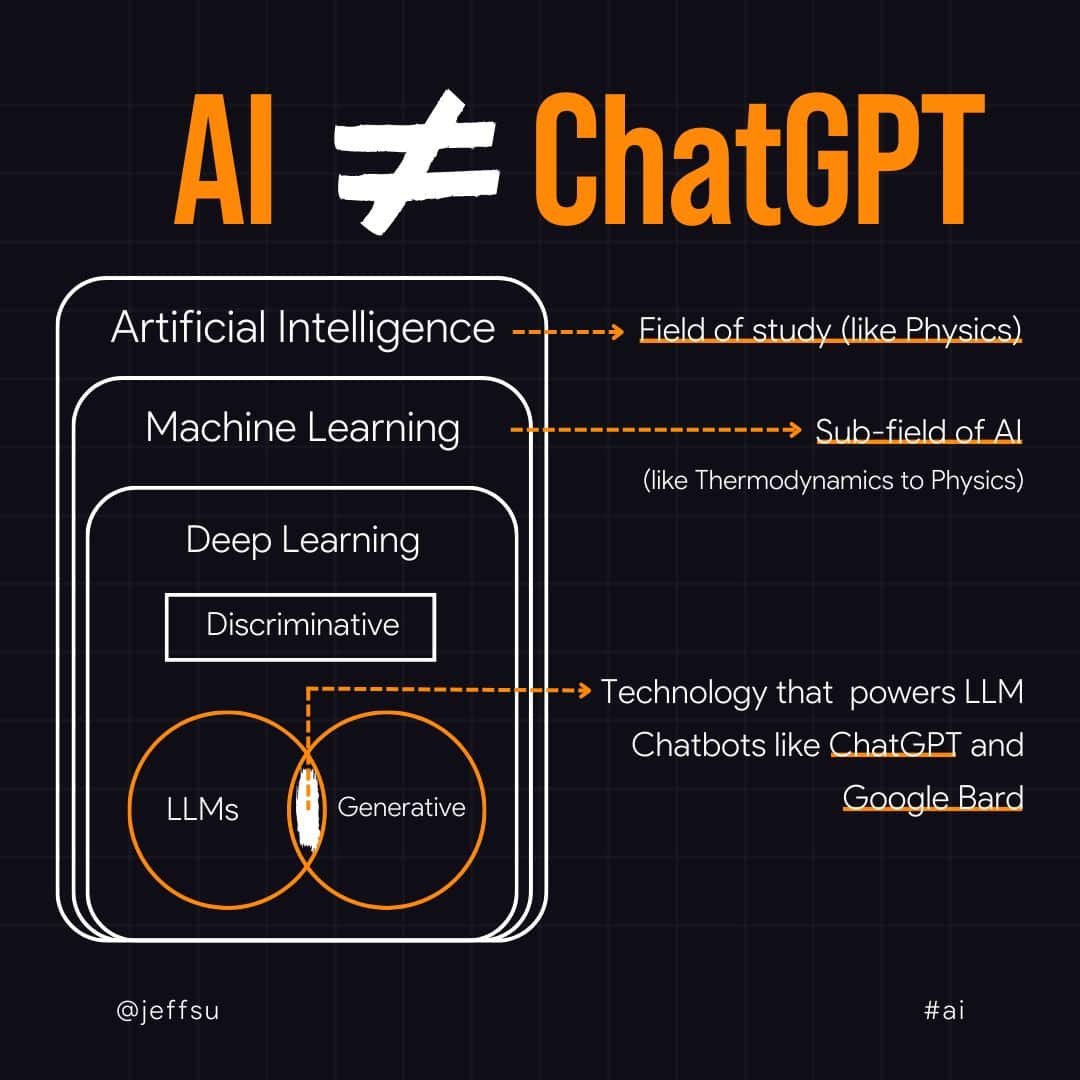

We’ve all heard the term “artificial intelligence” tossed around quite a bit lately. AI is an umbrella term. What we’re really referring to in most cases —at least in the context of receivables management businesses— is machine learning, large language models (LLMs), and generative AI.

Each of these is being increasingly incorporated in new and interesting ways when it comes to making the most of thin margins, improving performance, and maintaining consistent compliance. Still, navigating this new compliance terrain is not without its challenges. This blog will focus on insights for beginning your AI journey in debt collection, specifically from a compliance perspective.

New Demands on Compliance Officers

One of the main challenges to regulatory bodies and businesses in implementing these new technologies is and will continue to be, “how do we regulate and maintain compliance for something so quickly evolving, with such vast implications, that is still not well defined or commonly understood?”

As AI in vendor technology and business use continues to grow, compliance officers and regulators now find themselves with new homework to be done in understanding the potential, the challenges, and the implications of new technologies. As a springboard into this conversation, the following are a few broad tips that apply to all debt collection companies looking to capitalize on AI technologies.

Understand the “Black Box”

Key to doing that homework is being comfortable asking the right questions in the right rooms with the right people. Coming from compliance backgrounds rather than technology backgrounds means sometimes we will have to risk looking or feeling foolish. It’s not always fun, but it has to be done.

The CFPB has made it clear that financial institutions, including debt collectors, must be prepared to explain to regulators what drives the models that machine learning algorithms and decisioning are built on. When it comes to “black box AI,” some key concerns to watch out for include bias, lack of transparency/accountability, and data privacy.

Utilize AI for Identifying Exceptions

From a compliance perspective, one of the key efficiencies worth exploring is processing through large amounts of compliance-relevant data (such as disputes, phone calls, etc.) and sifting out the exceptions that need to be manually reviewed.

Testing and risk assessments will be critical to managing this type of automated system effectively and compliantly. You’ll also want to keep a close eye on consumer feedback to identify and remediate any potential issues as quickly as possible.

Ensure “No Harm” on the Digital Consumer Journey

AI products for internal processes are often less risky than those for consumer communication. So it’s important to keep in mind that AI products for debt collection, such as those that use natural language processing and generative AI to communicate with consumers, must not cause harm to consumers.

The CFPB is very sensitive to the consumer experience. The use of a chat bot or other communication with consumers must be thoroughly tested from the user end to ensure an effective experience with as little potential for frustration or confusion as possible. Consumers should not feel like they’re “getting the runaround.”

Besides avoiding frustrating communications, it’s also important — as it is with machine learning tools — to avoid potential discrimination. Take the time to scope out potential challenges with knowledgeable consultants.

Create a Cross-Departmental Committee

As your company begins to build out guardrails for the use of AI tools across operations, we highly recommend establishing a cross-departmental committee. This will be important to ensure that everyone at the table is able to contribute feedback on challenges and implications particular to each team’s processes.

Hear more on this topic in this episode of Receivables Podcast:

If you’re interested in help with scoping things out on your AI journey from a compliance perspective, our team is here to help. We work with teams as either consultancy support to guide existing compliance teams or as outsourced compliance to stay on board with your business throughout the compliance journey. Contact us if you’d like to start with a free mini-consultation to see if we might be a good fit for your needs.

About ARM Compliance Business Solutions, LLC

ARM Compliance Business Solutions (ARMcbs) is a woman-owned U.S. based consultancy that serves creditors, collection agencies, debt buyers, collection law firms, and receivables service providers.

The ARMcbs services are designed to provide organizations of all sizes the tools and skills to overcome their unique compliance and business risks related to consumer financial laws, bringing operational strategies and compliance processes together.