Compliance Risk Assessments

Compliance Risk Assessments

Compliance Risk Assessments

Compliance Risk Assessments

RMAI Certification Audits

Your CMS Matters

Regular assessment of the Compliance Management System is a critical component of a strong financial services business. Not only will an assessment help businesses identify and prevent risk, it will also guide them in locating areas of opportunity to reduce waste. Clients are able to find a positive return on investment when money and resources are saved through process improvements, risk prevention, technology adjustments, and gap closures implemented as a result of the findings.

Your CMS Matters

RMAI Certification Audits

Regular assessment of the Compliance Management System is a critical component of a strong financial services business. Not only will an assessment help businesses identify and prevent risk, it will also guide them in locating areas of opportunity to reduce waste. Clients are able to find a positive return on investment when money and resources are saved through process improvements, risk prevention, technology adjustments, and gap closures implemented as a result of the findings.

Compliance Exam Preparation

Compliance Exam Preparation

To prepare your organization for any type of compliance examination, we conduct highly confidential and in-depth risk assessments based on the size and complexity of your business before providing you with your risk profile. Risk profiles are based on a scoring methodology and include a comprehensive report. From there, your business is better able to proactively identify and preventively remediate any potential issues.

Compliance Exam Preparation

Compliance Exam Preparation

To prepare your organization for any type of compliance examination, we conduct highly confidential and in-depth risk assessments based on the size and complexity of your business before providing you with your risk profile. Risk profiles are based on a scoring methodology and include a comprehensive report. From there, your business is better able to proactively identify and preventively remediate any potential issues.

Your Compliance Management System Matters

Full Suite of Collector Training

In today’s complex regulatory landscape, ensuring compliance is not just a legal obligation but a crucial component of maintaining your business’s integrity and reputation. Regular third-party compliance risk assessments are essential for identifying and mitigating risks associated with regulatory requirements.

Benefits to Using a Third-Party to Conduct Your Organizations Next Compliance Risk Assessment

By incorporating regular third-party compliance risk assessments into your business strategy, you can proactively manage regulatory risks, enhance operational efficiency, and foster a culture of compliance and integrity. Invest in these assessments to safeguard your business and ensure its long-term success.

RMAI Certification Audits

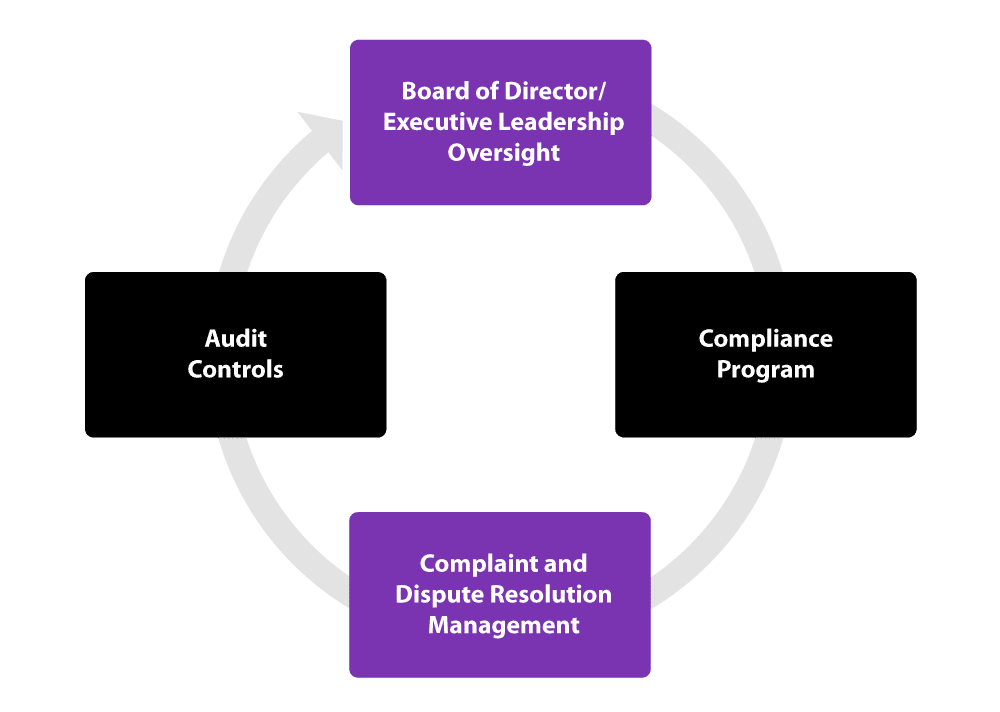

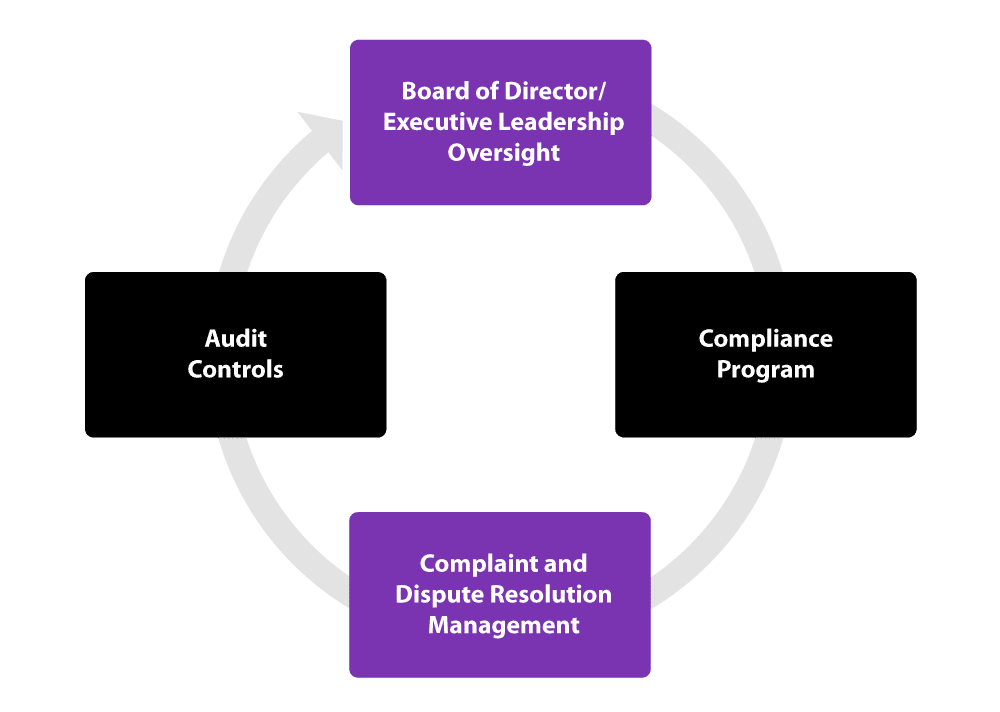

Elements of a Compliance Management System

Elements of a Compliance Management System

Risk Assessment FAQs

Risk Assessment FAQs

Your company has made an investment in compliance. You’ve likely hired additional personnel, spent countless hours developing policies, and established monitoring controls. It’s easy to operate with blinders on, not fully realizing your potential risks before it’s too late.

Risk Assessment FAQs

Risk Assessment FAQs

Your company has made an investment in compliance. You’ve likely hired additional personnel, spent countless hours developing policies, and established monitoring controls. It’s easy to operate with blinders on, not fully realizing your potential risks before it’s too late.